Tesco Bank Foundation

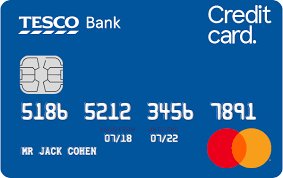

For those who are thinking about making purchases with a points program, the Tesco Bank Foundation credit card could be a good alternative.

In this article, you will understand how this program works, as well as many other aspects of the financial product in question, such as its main advantages and disadvantages.

Analyzing all of this will be essential to reach a conclusion as to whether it is really worth applying for membership in these cards.

Why we recommend the Tesco Bank Foundation Credit Card

In fact, there are several alternatives when it comes to credit cards, so it is important to check what their main strengths are.

Which demonstrates why it is worth applying specifically for Tesco Bank Foundation credit cards, rather than simply applying for another financial product.

In this case, we have the possibility of requesting a very complete card, made up of several programs and benefits, which allow purchases in a comfortable way.

Satisfactorily serving both those customers looking for something more basic and for a more everyday application, where the main point to be considered is reliability.

As for offering all the necessary means for those who need a financial product that offers a much more complete service, with comprehensive use.

So, we could summarize the difference of the Tesco Bank Foundation credit card as being a very complete financial product.

What can I use the Tesco Bank Foundation Credit Card for?

It’s time to understand more about exactly how to use the Tesco Bank Foundation credit card, something that makes all the difference.

By understanding how to use a financial product, it becomes easier to choose whether or not it is worth becoming a holder, avoiding making a common mistake.

Many users end up not using all the tools available to them, something that happens because they are not familiar with all the card’s functions.

To avoid this, here are the two main ways to use the Tesco Bank Foundation, but keep in mind that there are many others.

Purchases with points program

When purchasing, a points program ends up completely changing the dynamics of consumption, as your spending starts to make much more sense.

Enabling more economical purchases in the long term, especially when it comes to using programs that allow comprehensive exchange.

But what exactly do we have in the Tesco Bank Foundation credit card points program? This is the Clubcard program, which has a very comprehensive accumulation method.

Where, in addition to using the card in question, the use of other bank products also allows the user to accumulate points, which will be managed by the application.

These points can be exchanged for products or services, as per the offers available on the Tesco Bank Foundation app.

Payments made internationally

In addition to a good points program, the credit card offered by Tesco Bank Foundation also makes it easier to take international vacations.

The way this happens is simple, a quality payment changes everything about a vacation trip, even allowing you to have a more appropriate rest.

After all, without having to worry about going to currency exchange offices, it becomes much easier to dedicate your time to visiting tourist attractions or just enjoying the hotel.

This is a card that also ensures that no matter where you go, the Tesco Bank Foundation Card payment services follow you.

Since it has the Mastercard brand, it can be used to travel to hundreds of countries, after all, this is one of the most accepted brands.

Advantages of the Tesco Bank Foundation Credit Card

To ensure that we are making an assertive decision, whether regarding requesting or dispensing with a financial product, we must adopt some measures.

Knowing its main advantages and disadvantages is one of the main ones, as it is a way of analyzing whether this is a good way to make payments.

Therefore, we have selected the main strengths of the Tesco Bank Foundation card, which will be listed below:

- Contactless payment

- Credit card accepted globally

- ClubCard points program

- Application to manage the card

- Fully remote request

- Anti-fraud systems

- Practical for digital purchases

Disadvantages of Tesco Bank Foundation Credit Card

The Tesco Bank Foundation credit card has requirements that are considered to be quite strict, especially when it comes to credit criteria.

Where, candidates must have a good credit score and stable income, without this, it will be impossible to become one of the winners.

There is also the possibility of receiving a considerably low initial limit, an issue that some holders report on review sites.

How is the credit analysis done on the Tesco Bank Foundation credit card?

The credit analysis of Tesco Bank Foundation credit cards uses the customer’s Score to determine whether approval has occurred or not, and is also used to choose the limit.

As with loans, financing and other financial services, you will need to present an adequate score to increase your chances.

Is there a maximum and minimum amount for the Tesco Bank Foundation Credit Card?

The Tesco Bank Foundation credit card has a very well-defined limit, with the bank disclosing both the minimum and maximum amounts.

When selected, holders can receive a limit ranging from 250 to 1,500 Euros, serving different customers with very different credit profiles.

Making it well-suited for both those looking for a complete credit service and those interested in cheaper purchases.

The limit is chosen taking into account each person’s credit needs, where the more credit you need, the more limit will be made available.

Want to apply? Learn how to get the Tesco Bank Foundation credit card right here

Want to learn how to apply? To do so, click the button below and check out the steps to become one of the candidates, the entire application is done remotely.