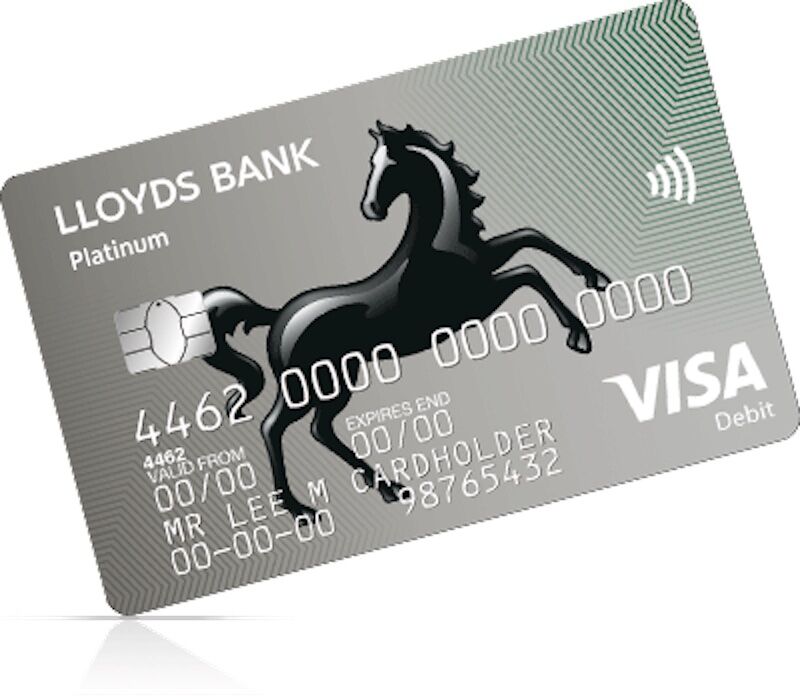

Lloyds Bank Platinum

With the Lloyds Bank Platinum credit card we have some pretty grand promises, such as fast approval and a very complete credit service.

However, it is necessary to analyze it in detail, to find out whether the financial institution really managed to fulfill everything it promised when issuing this card.

That’s exactly why we’re here, where we’ll show you exactly how this credit card works, covering not only its advantages, but also its disadvantages.

Why we recommend the Lloyds Bank Platinum Credit Card

First of all, why exactly do we recommend that you use this credit card? The first strong point is that this credit card can be applied for quickly.

Where, just like the application, the approval of the membership request also occurs in a few minutes, which is great news for those who are in a hurry to start buying with a card.

However, the speed and low bureaucracy of Lloyds Bank Platinum is not the only reason for users to order the financial product in question.

It is in the Platinum category, where this feature allows the card to be incredibly robust, something excellent for those who want to buy comfortably.

This robustness can be observed at various times, however, the place where this is most notable is in the credit limit of the credit cards in question.

Which are much higher than usual, enabling high-value purchases, more comfortable installments, among many other positive changes in consumption.

What can I use the Lloyds Bank Platinum credit card for?

The Lloyds Bank Platinum credit card has a wide range of uses, which is also due to the category in which this financial product is located.

Because, having more benefits in your benefits grid, it becomes easier to explore different ways of use, always being covered by some program or benefit.

But if this is your first time using a Platinum card, it can be a little strange to understand how far this financial product can go.

So it is very important to check which are the best applications, we have selected two of them and below we will show you in detail.

Interest-free purchases and balance transfers

For a certain period, the Lloyds Bank Platinum credit card is exempt from interest on two of its main features.

First, we have the balance transfer, which is very important for anyone who is thinking about concentrating their debt on a single credit card.

Interest rates may end up making it impractical to resort to this type of use, the same goes for the second type of exemption on this credit card.

Where, for a few months, at Lloyds Bank Platinum we have no interest rates applied to the value of purchases, being a nice welcome gift.

In both cases, the benefit begins to apply from the moment the credit card is approved and activated via the official app.

High value purchases

It would be a big mistake to talk about the Lloyds Bank Platinum credit card without talking about one of the main possibilities as a holder.

Users of this financial product can use it to make high-value purchases much more comfortable for their finances.

Just think, for example, about buying electronics, home furnishings, or that international vacation that until then seemed like just a dream.

However, with Lloyds Bank Platinum credit cards you have a very flexible credit limit and the possibility of paying in installments.

By properly managing the limit released by the bank for this financial product, the possibilities become endless, something that is made easy by the bank’s app.

Benefits of the Lloyds Bank Platinum Credit Card

Do not apply for the Lloyds Bank Platinum credit card without being aware of the main benefits, check out a brief list of the main strengths below:

- Very high credit limit

- Control application

- Remote credit application

- Approval in up to 5 minutes

- Contactless payment

- Insurance for online purchases

Disadvantages of Lloyds Bank Platinum Credit Card

The Lloyds Bank Platinum credit card is a financial product with very strict approval criteria, so not everyone can apply.

Therefore, if you are looking for a good financial product, but are just starting out in your financial life, the application and approval process can be quite complicated.

Additionally, some benefits programs can be complicated, with rules and conditions in place before they can come into effect.

How is the credit analysis done on the Lloyds Bank Platinum credit card?

The analysis carried out by the bank to release the credit limit on the Lloyds Bank Platinum credit card uses the Credit Score.

Where, the financial institution releases a limit proportional to each person’s credit needs and payment possibilities, where a rule is applied.

The higher your credit score, the easier it will be to get not only approval, but also a much higher credit limit.

Is there a maximum and minimum value for the Lloyds Bank Platinum credit card?

Checking the official Lloyds Bank Platinum credit card website, we did not find any information regarding its credit limit.

Therefore, we will not be able to inform you of anything regarding the maximum or minimum value of the cards, however, remember one detail regarding this financial product.

Being a Platinum credit card, it is common for its limit to be quite high, so you can expect a very interesting amount to use as you wish.

However, if the initial limit is still not enough for you, you can use the application to request a new credit analysis, with the aim of increasing the limit.

Want to apply? Learn how to get the Lloyds Bank Platinum credit card right here

Are you interested in applying for the Lloyds Bank Platinum credit card? Click the button below and check out the steps to become a candidate.