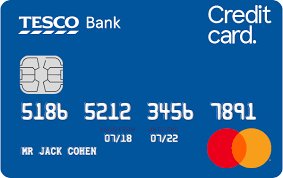

Tesco Bank Foundation

-

Starting credit limits between £250 – £1,500 and monthly repayments from £25

You may be considered for regular credit limit increases if you make your minimum payments on time, stay within your credit limit and similarly manage any other credit cards or loans you have with us.

-

Track your credit score

Get access to Tesco Bank CreditView, provided by TransUnion, for 3 years from account opening and track your credit score with monthly updates.

-

Collect Clubcard points

Almost everywhere you spend using your card, plus your usual points in Tesco. For more information see Credit Card Rewards.

Purpose: Aimed at individuals with limited or poor credit history, to help build credit.

Initial Credit Limit: £250 to £1,500, subject to credit assessment.

Representative APR: 29.9% variable.

Balance Transfer Fee: 0.99% to 3.49%, depending on the card.

Cash Withdrawal Fee: 3.99% (minimum of £3).

Annual Fee: No annual fee.

Additional Benefits: Earn Clubcard points on purchases, access to Tesco Bank CreditView for credit monitoring.

This card is excellent for individuals looking to build or rebuild their credit.

With the ability to earn Tesco Clubcard points, it offers some rewards for everyday purchases.

However, the 29.9% APR is high, and the balance transfer fees may reduce its appeal for larger transfers.

Using your cell phone and the official website of the Tesco Bank Foundation credit card, you will be able to become one of the candidates for ownership.

To do this, you just need to follow a few steps, which, if you learn to do them correctly, can be completed in just a few minutes, depending on the experience of each candidate.

Whether this is your first time applying or not, check out this article to find out all the steps you need to take to apply for the card in question without even leaving your home.

What are the requirements needed to apply?

But what are the steps to apply for the Tesco Bank Foundation credit card? It all starts by checking a short list.

Composed of requirements, where it will be necessary to meet the criteria established by the financial institution to be entitled to apply for credit.

In this case, we have some considerably strict criteria, despite it not being one of the most difficult financial products to apply for.

Check out below what you must do to apply for Tesco Bank Foundation credit cards:

- Prove stable income

- Be of legal age

- Lives in the country

- Have a good credit score

What documents are required?

In addition to everything we have presented previously, it is also very important that you have all the documentation required by the bank.

This is the second stage of applying for Tesco Bank Foundation credit cards, and it mainly serves to prove that all requirements have been met.

As this is a completely remote request, all documentation must be sent digitally, using the bank’s official website or app.

That said, check below which documents are required to proceed with the request:

- Proof of income

- Proof of residence

- Photo ID

All documentation must meet two requirements, being within the correct validity date and with all data completely visible, this will avoid requiring the documents again.

What are the biggest uses of this credit card?

Before you apply for a Tesco Bank Foundation credit card, be sure to check out the main ways to take advantage of its benefits.

For this, we have a very extensive list of motorcycles in use, but it would be impossible to cover them all in detail in a single article.

Therefore, we have selected only the three modes of use where the greatest advantages of the Tesco Bank Foundation credit card will be put into practice.

However, you should know that with the Tesco Bank Foundation credit card application you can check the other ways of using it. Now, see below how the three main applications work.

Building a credit history

The first great use of the Tesco Bank Foundation Credit Card is the ability to build a better credit history through purchases.

Spending frequently, with a quality credit card, is one of the best ways to improve your credit history.

Your Score is also positively affected by conscious consumption, something that becomes considerably easier when using a financial product like this for payments.

While it may not be as affordable as other loans, it is affordable enough to make it possible to improve your credit history to get more chances at more robust cards.

Emergency purchases

Unfortunately, we always end up facing financial emergencies, where if we don’t have good planning, we will end up having serious problems.

There’s nothing better for making a last-minute purchase than a credit card, as the Tesco Bank Foundation has two essential features at a time like this.

Firstly, your limit is quite flexible, reaching up to 1,500 Euros, which is essential for dealing with slightly more expensive financial emergencies.

However, that’s not all, as we have the second feature, the possibility of paying for purchases in installments, so that the financial damage caused by the emergency is reduced.

Installment purchases

Installment purchases are not just a very efficient way of dealing with financial emergencies that occasionally arise along the way.

You can also use it for those times when buying something in installments becomes more advantageous than saving for months until buying outright.

For example, when buying an electronic device, which generally ends up being quite expensive, if the device is on sale, paying for the purchase in installments and purchasing the device now can be much more advantageous than waiting.

In this case, being able to use the Tesco Bank Foundation credit card to pay for your purchase in installments will be essential for a good purchase.

Our advice for anyone applying for the Tesco Bank Foundation Credit Card

The Tesco Bank Foundation credit card, as well as other financial products and services from the bank in question, is included in the Clubcard program.

It allows you to accumulate points using your credit card as a payment method, but there are rules and conditions to be considered.

Therefore, before you go shopping, check the rules, which apply to both accumulating points and exchanging acquired points.

A quick search on the bank’s app, after being approved, will be more than enough to understand the program’s rules.

Weighing up the pros and cons – Is it worth it?

Are you interested in applying for the Tesco Bank Foundation Credit Card? Then it’s important to start by answering one crucial question.

Is it really worth applying for membership? The answer changes completely depending on the client for whom it was made.

But in general, the answer can be easily obtained, just compare the pros and cons, looking for what weighs more for you.

In addition, it is also recommended that you check online what the rating of Tesco Bank Foundation cards is, given by other users, where on some sites, the rating is 4.2 stars;

Apply once and for all for the Tesco Bank Foundation credit card on the official website!

Want to apply for the Tesco Bank Foundation credit card? The entire application process is done through the app or official website, click on the button.